“This post is part of a social shopper marketing insight campaign with Pollinate Media Group® and TurboTax, but all my opinions are my own. #pmedia #TurboTaxACA http://my-disclosur.es/OBsstV”

It’s the most wonderful time of the year is not something you will hear a lot of people say about tax season, but not this girl. When I was first out on my own and realized that I was going to need to file taxes I tried one year to do the good old fashioned paper and pen method. IT WAS A NIGHTMARE!! I was confused, searching through tax booklet after tax booklet trying to make sense of what should have been a super easy process. I mean I was a college student with one part time job. It doesn’t get much easier than that when it comes to taxes!

My freshman year of college in Hawaii!

The next year I started using TurboTax and I was blown away at how easy it was. I’ve been using TurboTax for over 10 years now (how did I get so old??) and despite marriages, children, divorces, self-employment, small business, remarriage and multiple home ownerships I have never once stressed out about doing my taxes because I know that TurboTax has my back.

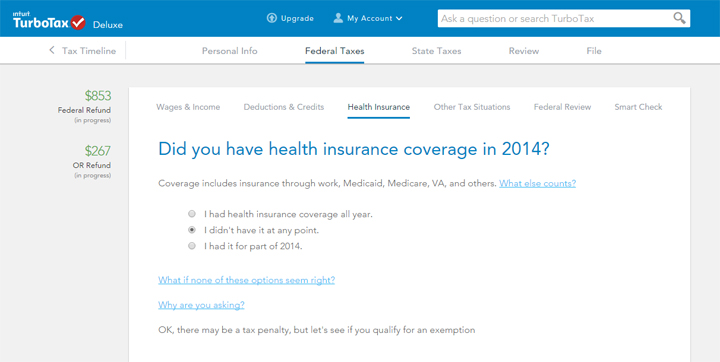

This year as I was filing mine (and subsequently my sister’s) I came to a section that I had never seen before. Healthcare. Um, what? I have to admit, I was a little nervous because I’ve never had to tell the IRS about my health insurance status or the status of my kids and hubby. I was also nervous because for the majority of last year I was uninsured. I was a stay at home mom and a blogger. Last time I check neither of those jobs come with healthcare. When I started teaching in the fall I did get coverage through my school so I was worried about what kind of hot mess of paperwork I was going to need to get through this. So instead of me telling you how easy it was, I want to show you.

Do you feel the panic coming on?

Do you feel the panic coming on?

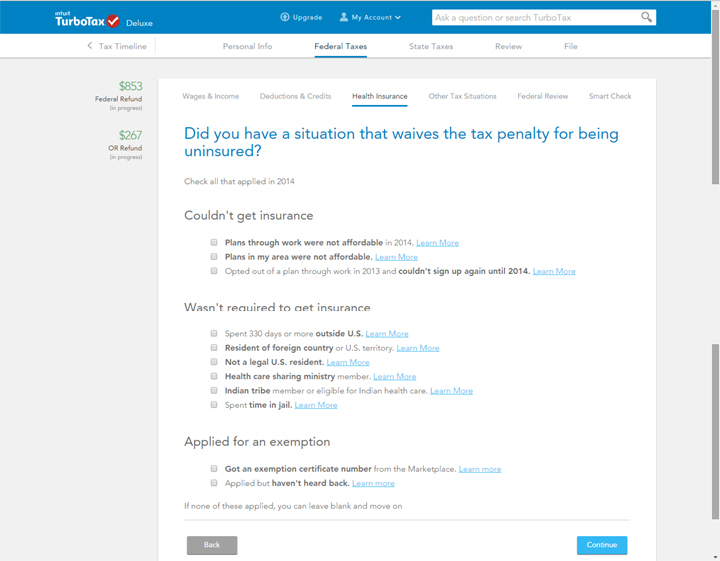

Umm, holy choices Batman!

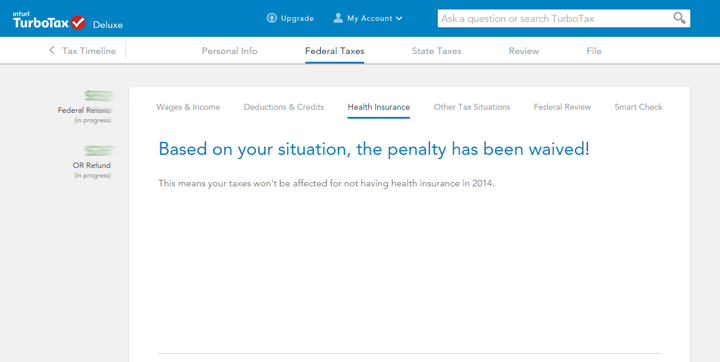

Well that was easy enough, but what does that even mean!?

HOORAY!!!!!!

See what I mean? TurboTax walks you through all the scary stuff and helps you stay out of trouble all the while helping you get back all your hard earned money! Now if you’re not sure if you will have a penalty or if your situation will get you a waiver I suggest checking out as soon as possible. Health insurance open enrollment ends on Sunday, February 15. This is the last chance you’ll have to purchase insurance to avoid a penalty on your taxes next year. You can check out TurboTaxHealth.com to learn more about your health insurance and taxes, including finding out if you’re exempt from the tax penalty. While you’re at it, don’t forget to go to TurboTax.com to file today for absolutely free before February 16 if you have a simple return (1040A/EZ).