I’ve spent a lot of time thinking about how to write this #MarchIntoSavings #CollectiveBias post. I want to share with you things about my life and my family’s goals, but the internet can be a big scary place sometimes and it can be easier to keep quiet than spill your beans. Most of you know (especially if you’ve been around a while) that I spent a few years at home with my kids when they were really little. Those of you who know me in real life were probably surprised when I decided to do this. See I was never the kind of woman who wanted to be a stay at home mom. Stay at home wife, yes. Self-employed business owner, yes. Just me and my little people all day every day, not so much. I am a driven and ambitious woman, who thrives in a professional work environment. I have found that I am a better mom when I am a working mom.

Back when we decided that I would quit my job and stay home, my husband had just graduated from school and landed a pretty sweet job. This job required us to move about an hour away from where we were. We decided that with the move, and the new school for our son and the hassle of finding child care, plus the expense, coupled with the cost of commuting it all just didn’t add up. So I began my adventure as a stay at home mom. About 6 months in, I started blogging. I told you, working mom = happy mom. Then last summer I decided to apply for a couple of teaching jobs “just to see what happened”. Wouldn’t you know it, I got hired to teach 4th grade. This started a domino effect of trying to find a nanny (three kids in daycare costs as much if not more than a nanny), swap out our old run down vehicles for fuel efficient newer ones, and try to balance the work all day, parent all night, who needs sleep anyways kind of lifestyle we were entering.

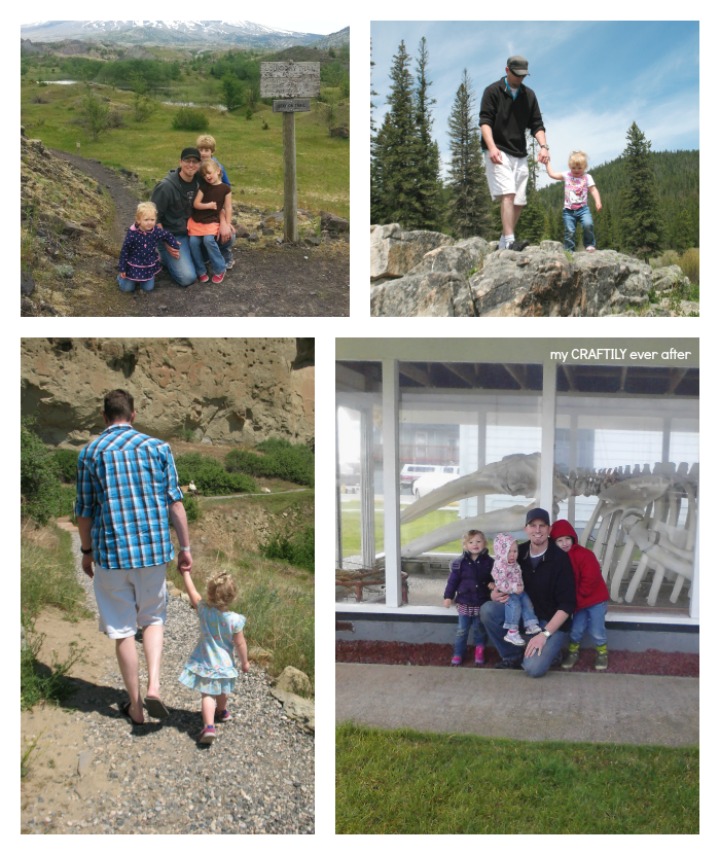

Now during the past 6 months since I went back to work I have realized a few things. First off, we have a great nanny. She loves my kids, takes them out on adventures and she keeps my house tidy (I love you Emily!!), but she isn’t the same as a parent. Now we all know that I am not cut out for stay at home momming, but my husband, he would be the perfect stay at home dad. He is so good with the kids, has endless patience, and isn’t annoyed by things like school drop offs and pickups (hello, who taught some of these people how to drive!!!!) unlike me. So we have been kicking around the idea of him cutting back to part time once the kids are all in school. He could be the one to take them there, drop them off. He could make breakfast and finish homework and make sure they knew how loved they were by us before heading off to work in the morning.

3 SIMPLE CHANGES

In order for this to even be an option we need to finish paying off all our debt. Over the past 5 years we have knocked off everything except our new car payments, our mortgage and my student loans. We’ve been working hard and chipping away at these things as well. Our goal is to be debt free before the kids graduate. So we’ve been reevaluating our priorities. And we came up with these three EASY ways to cut back each month.

TV – $90 a month savings

As a family of five it seems like someone is always watching something on TV. Whether it’s the kids watching cartoons, my hubby watching his science shows or me watching HGTV, there is always something on. Recently we realized that pretty much everything we want to watch we can find on Netflix. The only we can watch there are the Seahawks. See we love sports, but other than football, we don’t need regular TV. So, we suspended our satellite for the summer. This is one of the benefits of Directv, we can turn our service on and off whenever we want, for up to 6 months a year. So after the Superbowl, the satellite gets paused and the money stays in our bank account!

Electricity – $200 a month savings

We have a kind of big house. 2100 square feet of completely finished living space, and heating all that space takes A LOT of energy. Now it’s not an option in those winter months, but once spring time hits keeping the heat up becomes more of a luxury than a necessity. By not using our central heat from April through October, and discovering that sweatshirts and socks work just as well we save on average $200 a month.

Cell Phone – $70 a month savings

Our kids don’t have cell phones (yet) and my husband’s is covered through his work so really we only have one phone plan. Somehow that costs $92 a month!!!!! For what!!! I never use even half my minutes or texts and my data, maybe 1/4 of it. So I started thinking about how I could cut that one down. Then I learned about Walmart Family Mobile. I was skeptical at first, but once I read ALL the fine print (yeah, I’m that kind of girl) I realized that it was kind of a no brainer. For $29.88/month you get unlimited talk, text and 500 MB of 4G LTE data!!! Since I am almost ALWAYS connected to wifi, I never come close to touching my data as is. Best part, no contract. Try it out, see how it goes and if you hate it, you just quit. That’s the kind of thing a girl can get on board with!

I was really worried about the phone I would get though, I am kind of a phone snob. The thing is they have most of the same phones you can get anywhere else and you can also bring your own (check first because there are some restrictions). My current phone wasn’t an option for transfer so I picked up the Galaxy Avant. It was actually pretty comparable and took zero time to get used to. I am a serious Android lover and so to have all the same features and options was ideal for me! In fact I don’t think I’ve ever had such a smooth transition from one phone to another. I’ve been using it now for a few weeks and I absolutely love the service and I especially love the price! Because, let’s be real, $70/month is going to get us out of debt even faster!

How do you save money? Share your secrets in the comments below!

Disclaimer: All prices for phones and plans included in this post are accurate as of the date of posting; however, these prices are subject to change. Please refer to http://cbi.as/aafid or your local Walmart for current pricing.